Finzr Pay - Solution Paiement Fractionné 3x 4x pour Garages et Concessions Automobiles

Turn your quotes into paid invoices. Finzr Pay is the app that secures your cash flow and offers flexibility to your customers.

Repair costs are skyrocketing.

Your customers feel it.

€718 on average in 2024, vs €657 in 2023¹. Result: 25% of your customers postpone their appointment for fear of the cost, and only 15% do preventive maintenance².

Offering split payment is no longer optional—it's an essential conversion lever.

- Increase your average basket by 25%

- Retain customers looking for flexibility

Powered by Floa

European leader in installment payments, a BNP Paribas subsidiary.

Floa simplifies payments for over 4 million customers and 15,000 merchant partners across Europe. Voted Customer Service of the Year 4 times in a row.

4M+

Customers

15,000+

Merchant partners

7

European countries

Customer Service of the Year 2024

4th consecutive year in the "Credit Organization" category

Simple as a text message

No paperwork. An app designed for the workshop.

Quick entry

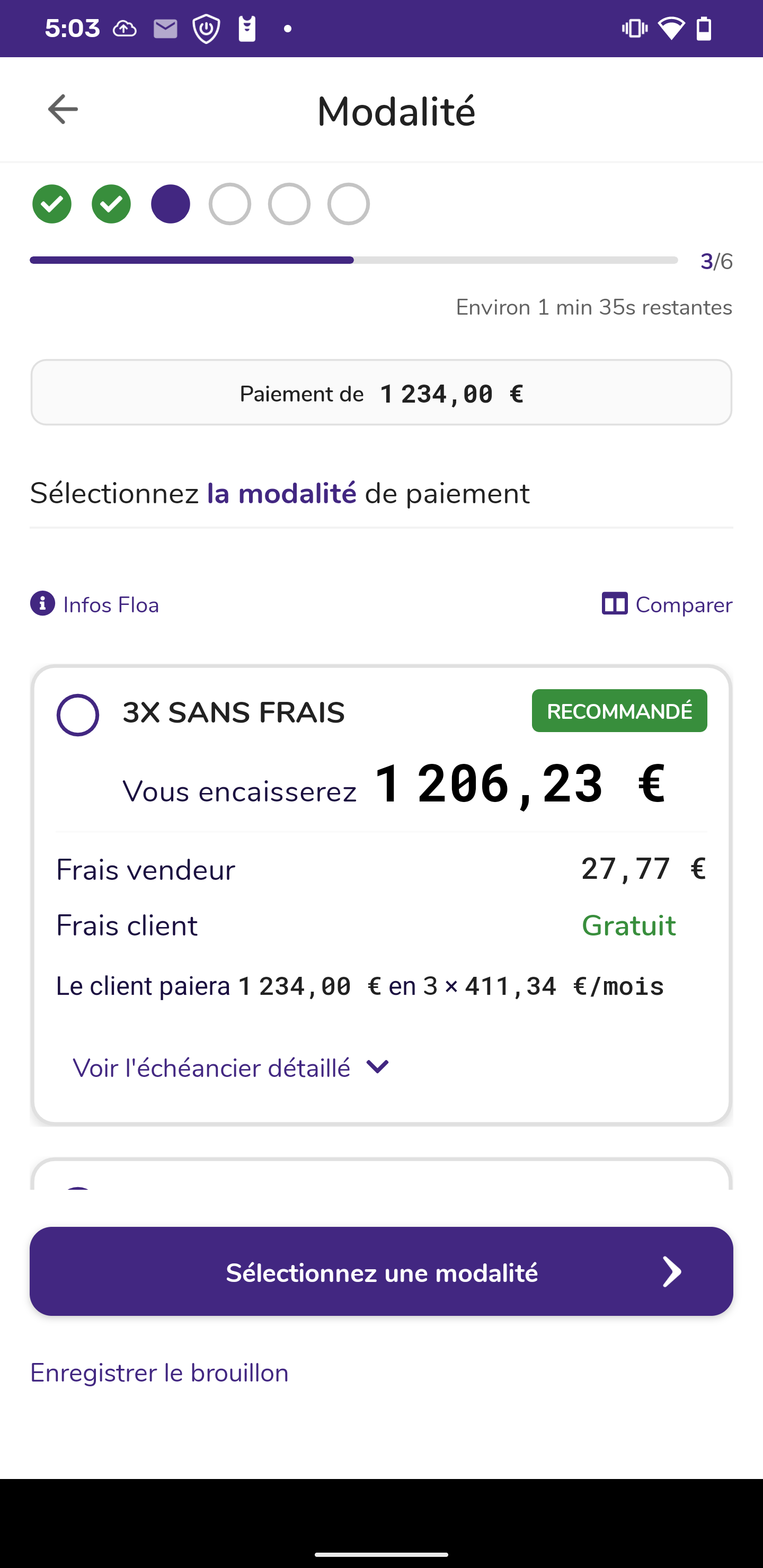

Enter the amount and customer's number in the Finzr Pay app. 20 seconds flat.

Customer validation

The customer receives a secure FLOA link via SMS. They complete their personal details and validate the payment by bank card*, and their payment schedule.

Guaranteed payment

You receive 100% of the amount within 48h by bank transfer. Your cash flow is protected.

* FLOA subject to acceptance of your application by FLOA and after expiration of the legal withdrawal period. FLOA Société Anonyme with capital of €72,297,200 - Registered office: Immeuble G7, 71 rue Lucien Faure, 33300 Bordeaux - RCS Bordeaux 434 130 423. Subject to supervision by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) 4 Place de Budapest, CS 92459, 75436 Paris cedex 09. Orias No.: 07 028 160 .(www.orias.fr).

Installment payment offer simulator

Simulation for illustrative purposes only. Rates shown are subject to change and determined by our partner FLOA.

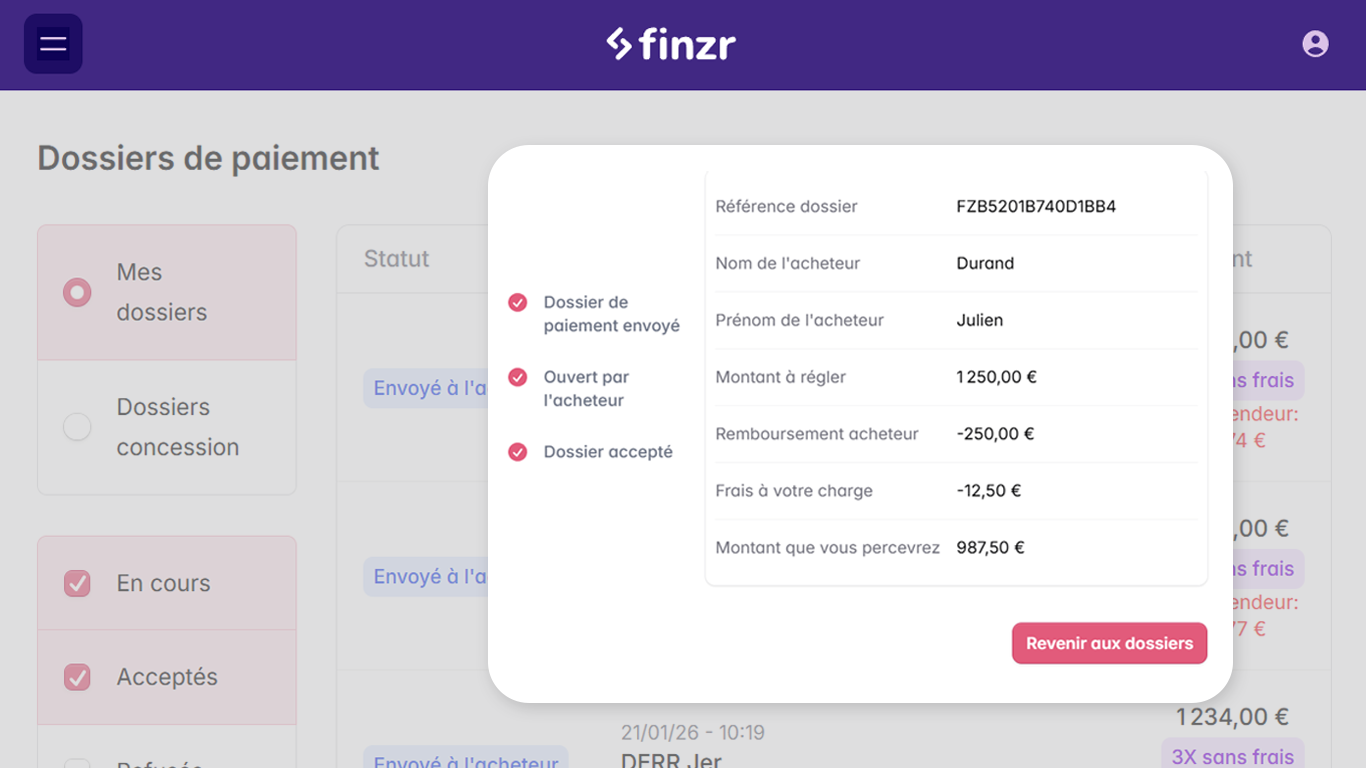

Stay in control of your payments.

In real time.

Track every payment file from a simple and intuitive interface. View statuses, amounts, and timelines at a glance.

Real-time tracking

Instantly view the status of each file: sent, opened by the customer, accepted, or declined.

Full transparency

Access details of each transaction: invoiced amount, service fees, and net amount received.

Multi-site management

Filter by salesperson or dealership for an overview or individual tracking.

Complete history

Access all your past files for simplified tracking.

Calculate your business impact

Estimate your potential gains based on 2024 automotive market data.

Your business

Number of repairs and maintenance invoiced

2024 market average: €718

Expected impact

You display the 3x/4x option and actively offer it to customers.

Data based on Journal Auto 2024 and La Dépêche 2024

Your potential with Finzr Pay

Estimated net annual gain

+80 327 €

ROI: 17930%

38 customers/month using 3x/4x

4 customers/month recovered

Realistic : 38 customers/month will choose 3x/4x, and you'll recover 4 customers who would have postponed.

Response within 72 business hours

Indicative simulation based on market averages. Actual results may vary depending on your business.

Become a partner

15 spots to shape the future of automotive split payment. Save €340 in your first year.

Activation fees

€100 instead of €200 setup fees

Reduced subscription

€29/month instead of €49 for 12 months

VIP Onboarding

Dedicated training session with our team

No commitment • Approval in 72h

Program reserved for professionals with over €2M revenue (groups, networks or established independents) • Check my eligibility

Are you eligible?

FLOA approval requires financial stability criteria.

Established automotive professionals

Garage groups (4+ sites)

Network franchisees (AD, Point S, Speedy...)

Dealerships & brand agents

Established independent mechanics (revenue > €2M)

Accessory retailers & parts distributors

E-commerce sites selling parts or accessories

Frequently asked questions

Everything you need to know about how it works.

Ready to boost your revenue?

Join the 15,000 partners who trust FLOA. Approval in 72h.

Launch offer reserved for the first 15 partners.